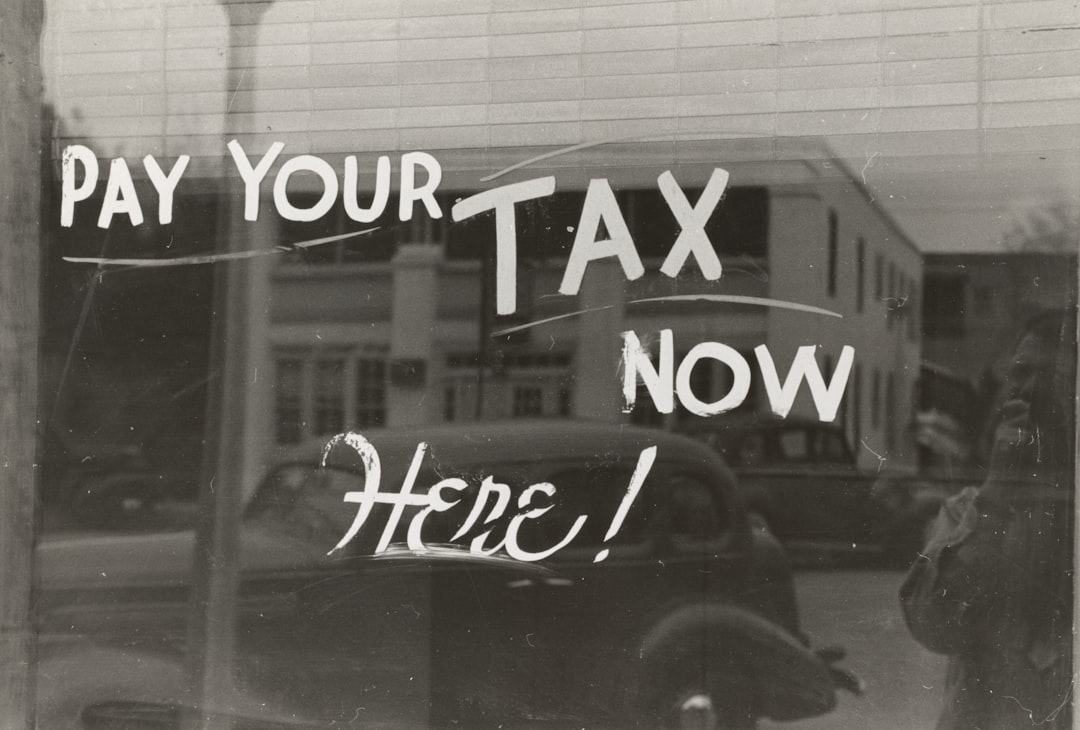

Mark Your Calendar: Key Tax Dates for 2025 You Can't Forget

Avoid Tax Season Stress:

Staying informed and prepared for tax deadlines is an essential part of running a successful private therapy practice. By keeping these deadlines on your radar, you can reduce stress, avoid penalties, and focus more energy on your clients and growing your business.

If you’re unsure about your specific tax obligations or need help setting up a system that works for you, consulting a professional can make all the difference.

Other posts worth reading…..

Key Tax Deadlines to Keep in Mind

Self-Assessment Tax Return

As a self-employed professional, you’re required to submit a self-assessment tax return each year to declare your income and expenses. This deadline typically falls early in the calendar year and includes both the submission of your return and the payment of any taxes owed for the previous tax year.

Tax Payments

Your tax obligations go beyond filing your return. You’ll also need to pay:

Any outstanding taxes from the previous year.

Payment on Account (POA): This is an advance payment toward your next year’s tax bill, divided into two instalments throughout the year.

Start and End of the Tax Year

The tax year runs from early April to early April the following year. These dates are critical for organising your records and knowing when to begin tracking your new year’s income and expenses.

Members continue reading for a breakdown of the important dates you need to know if you are a sole trader or a limited company; plus tips on how to manage your finances like a pro and build a sustainable practice.